Medicare Supplements are designed to reduce the risk of significant out-of-pocket expenses resulting from deductibles, co-pays or areas of coverage not included in traditional Medicare Parts A and B. To be eligible for a Medicare Supplement, you must be enrolled in Medicare Parts A and B

|

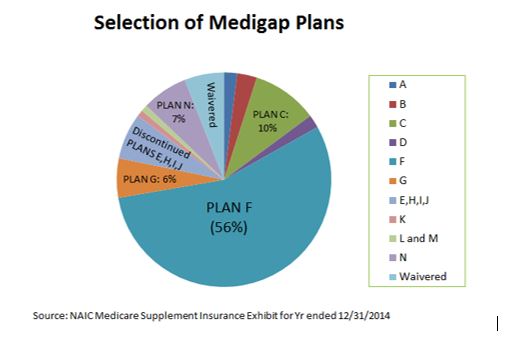

There are different types of Medicare Supplements (Plans A – N) and these are purchased from private insurance companies. The benefits provided by each Plan are defined in law so, for example, the benefits of one carrier's Plan F is exactly the same as another carrier's. Note that premiums and underwriting may differ though. The Medicare Modernization Act redefines all Medicare Supplements sold after 6/1/2010. This Act eliminated the continued sale of Plans E, H, I and J though clients who previously purchased these plans are able to keep these coverages. Though there are many plans to choose from, a few plans predominate. Below is a pie chart showing the market share of each of these plans. You can see that, by far, most people choose Plan F which provides the most comprehensive coverage.

|

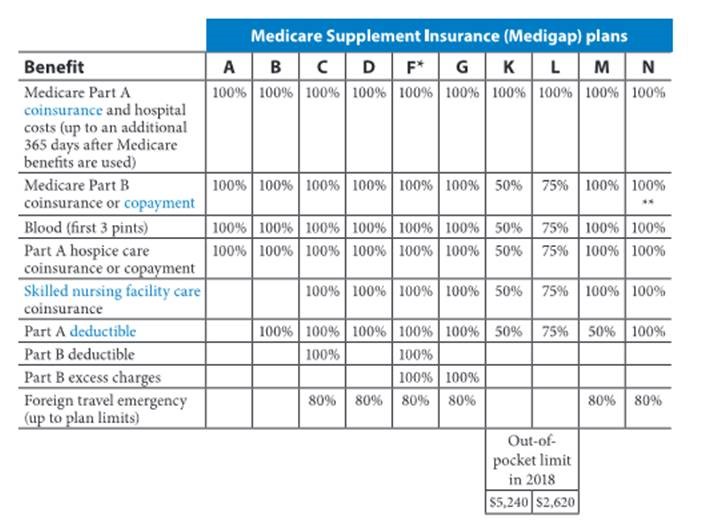

Below is a chart providing an overview of the coverage of each of the plans that can now be sold. Plan F is the most comprehensive coverage and, logically, it is also the most expensive. Though not shown on this chart, the asterisks under Plan N refer to co-pays for some office and emergency room visits.

Note that each insurance company determines the premiums charged to policyholders and premiums may vary according to your county or zip code, your gender, age, and whether or not you are a smoker. It's not unusual for plan premiums (for the same plan and individual) to vary by as much as much as 50% from one company to another. Additionally, premiums generally increase annually by varying amounts. The resulting variance in pricing and annual increases by different companies provides an opportunity for relatively healthy people to easily save money by comparing their current premiums to the premiums of other carriers. Advanced Planning Solutions can compare premiums for all carriers and frequently helps clients save money in this manner.

When initially applying for Medigap coverage, you can automatically qualify if your application is submitted during your Open Enrollment period. The Open Enrollment Period is based on your date of enrollment in Part B or, if you continue working past age 65, the date your coverage from an employer health plan ceased. Other exceptions providing Guaranteed Issue status exist but are not applicable for most people. If the Open Enrollment Period has passed, then the insurance company is likely to require that you answer health-related questions on your application for coverage. Higher risk applicants may be placed in more expensive, higher risk groups or the insurance company may refuse to offer coverage. The criteria to determine the risk class is determined uniquely by each company.